Commodity Trade Finance Funds

Investment Strategy

The objective of a CTF Fund is to generate attractive returns with limited risk and low volatility. For this purpose a CTF Fund enters into contracts with traders or producers of commodities or participates in such transactions.

Short-term trade financing is a safe investment compared to other asset classes, as the structural elements and the easily marketable collateral leads to much lower default rates and to lower losses in case of a default.

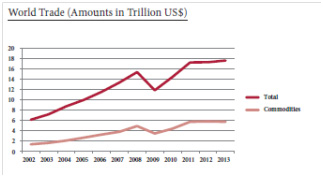

Global commodities trade has enjoyed positive growth in the past as shown in the table below:

A crucial point for the stable returns is also that the Fund performance does not depend on the raw material prices, but only on the supply and demand for financing of raw materials.

CTF loans show very little correlation to other asset classes as shares, bonds, real estate etc. This makes the CTF Fund an excellent instrument for investors who strive for further diversification of their portfolios.

CTF Loans are of a short-term nature and normally with a variable interest rate, therefore the margins are fixed and the interest rate risk limited.

While raw materials are often exported from countries with low credit ratings, CTF loans are subject to only small country risk, since the loan repayment is made from the purchasers of the raw materials who are mostly located in developed countries. In addition the risk is limited through suitable instruments such as letters of credit and insurance.